They Were Overpaying by $2,200 — And Had No Idea

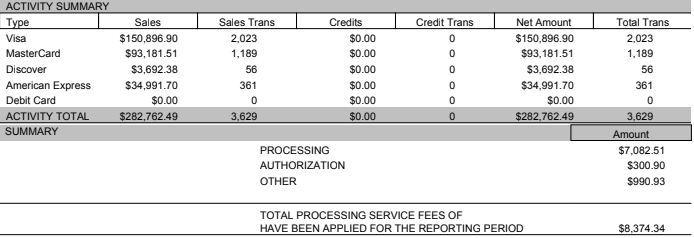

This wasn’t some broken-down point-of-sale system or a sketchy third-party processor. This was a well-known processor, charging a busy local business over $10,800 in April on $287,000 in credit card volume.

That’s 3.76% in total fees.

After we stepped in and negotiated, the same business processed $282,000 in June and paid just $8,374 — a full $2,432 in savings.

That’s a 2.96% effective rate.

Nothing changed on their end. Same system. Same setup. Same staff.

The only difference? Someone finally paid attention.

Most businesses aren’t watching this stuff. And processors know it. They slowly raise rates, bake in junk fees, rename charges to confuse you, and hope nobody asks questions.

This business didn’t know they were being overcharged because they didn’t have the time, the knowledge, or the energy to dig through all the nonsense on their monthly statement.

That’s where we come in.

For less than $1 a day, Trailblaze acts as your second set of eyes. We review what you're paying, compare it to what you should be paying, and negotiate with your processor so you don’t have to.

If you're reading this and can’t remember the last time you asked your processor for a rate review or if you’ve never tried it’s time.

Upload your latest statement and let us take a look. We’ll break down what you’re being charged and tell you straight up if it’s fair or not. From there, we’ll walk you through your options, and if you choose to move forward, we handle the heavy lifting.

No pressure. No switching processors. No guesswork.

Just real answers and real savings.